This blog focuses on the banking organizations that want to

- Create a custom mobile banking app solution.

- Automate the core operations and take them online for the customers.

- Digitalize the existing user experience and take everything online so that the data can be centralized and the overall operations can be improved.

This blog covers these three important points:

- Complete step by step process to develop a custom banking app solution, considering all the precautions and regulations.

- Best banking applications that are doing well in the market. This will help you to take some inspiration.

- How much does it cost to create a custom banking app solution?

Let’s explore mobile banking app development.

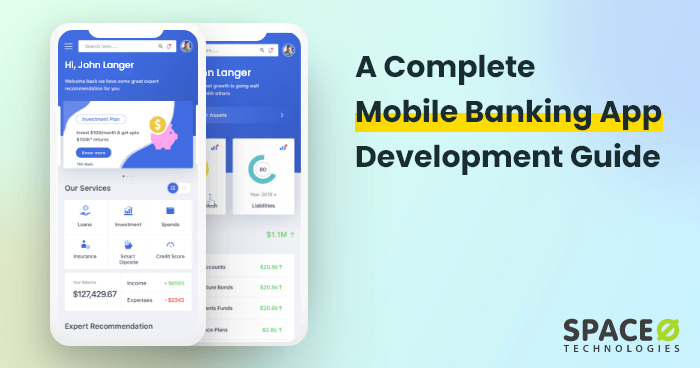

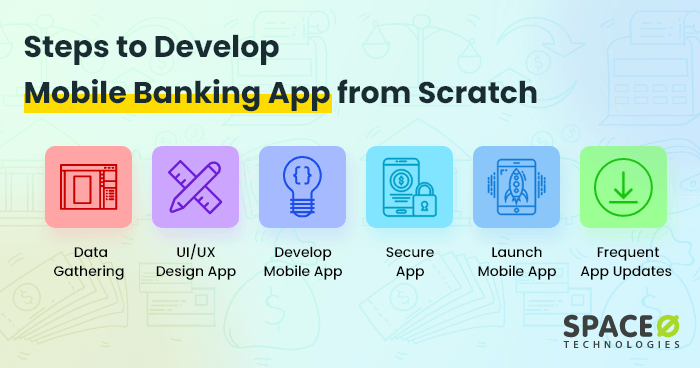

How to Develop Mobile Banking Application from Scratch in 9 Steps

When you are developing a custom mobile banking app, you must hire a trusted mobile app development company, that has experienced mobile banking app developers and follows the standard app development process. This will help you to ensure the quality of your mobile app remains excellent.

Here is the answer to how to create a mobile banking app. Applying these steps will help you build an exceptional mobile banking application for your organization.

Data Gathering of Existing Customers

Being a banking organization, you will have an existing user base. Now, prior to building a banking application, you need to gather the data of your existing customers who are already using your banking application.

By gathering that data, you will know how you can build the initial version of your banking app. For example, if your user base is of the age between 40 years to 60 years, or millennials will use your banking app then the features and the design should be implemented accordingly.

After defining the current and future audience, the next step will be to decide the features you will implement in your banking app.

Decide the Mobile Banking Features

If you are looking forward to developing a successful finance app, integrate these features into your mobile app. We have listed these features from a futuristic point of view, please have a look.

2.1 Add Core Banking Features

Account management is the heart of any banking mobile application. The below table includes all the essential features your banking app should have. You need to have these features in the MVP version of your application. And then, you can further integrate advanced features.

Feature Explanation Verify Account Balance Keep in mind that information in your app and on your website should be consistent and updated immediately. Monitor and Manage Different Cards Easily order a new card, close an account, monitor, and manage a bank account from your app. Check Recent Transactions Your mobile banking app’s transaction history is essential for account management. Check Deposits In addition to opening a deposit account, a mobile app should display deposit interest and its limitations. Quick Transactions To help customers to transact faster, this feature is essential to integrate. Fraud Alerts & Advanced Feature Whenever anyone tries to intrude into your bank account, a fraud alert will help you to solve such a case. Peer to Peer Payments Makes transactions fast and secure, this feature is used while integrating mobile payments Push Notifications Get transactional, promotional, and app-based notifications on your mobile device After finalizing the features, the next step will be to design a prototype for the banking app.

Build a Prototype of Banking App

Use these questions to create a proper prototype of a banking app.

- What needs are you trying to fulfill by designing the app?

- How you will use a specific solution?

To answer these questions, it is necessary to build an engaging prototype. After designing the prototype, test it with your target audience and check whether it fulfills your vision about the app usability.

Also, building a prototype is way cheaper and helps you to understand the clear flow of your design. It is the ideal solution when fixing a design flaw during the banking app development.

Consistent feedback on your prototype from users will also help to improve your banking app as well. Therefore, prototype building proves to be the viable solution to launch a perfect banking app without wasting your valuable resources.

Once the prototype is finalized, the UI/UX design of the app will begin, which we will discuss in the next step.

Want to Discuss Your Mobile App Idea?

We have experienced app developers who are skilled in building excellent mobile banking apps with the latest industry standards.

UI/UX Design of Banking App

The success of your mobile banking application development is determined by providing a seamless user experience and intuitive design. Customer attention is drawn by the attractive design, and customer retention is ensured by a user-friendly interface. Therefore, these two factors must be balanced.

Which points do you need to consider while designing your banking application? To develop the enticing mobile app, these points should be implemented in the banking app.

Points to Consider Explanation Functionality The UI/UX meets the basic functional requirements. The aesthetic aspect has little to no value. For a banking app, security is an essential point to consider. Reliability The design should be simple and to the point. The app should be built with consistent and stable performance. Usability The design should be easy to use, workable and it should enable insights and data. Proficiency The banking app should have all the accounts and required features in one place. Creativity The app should blend aesthetic beauty and modern interaction. Functionality and aesthetic look should be kept in mind while designing the mobile banking app. Developing a Mobile Banking App

Development is considered to be a time-consuming as well as a crucial stage.

Developers take the prototype and transform it into a live app at this point. Even while your development process will be highly dependent on the specifics of the product, some broad guidelines can assist you in making a smooth transition.

Native programming languages are recommended for iOS and iPad OS, as well as Kotlin or Java for Android. These are fully supported by Apple and Google, and provide you complete control over the app’s functionality. However, if you’re playing catch-up and need to get something out quickly to prevent client churn, React Native is a feasible choice (you get an iOS and Android version on a smaller budget and faster).

Technology Stack for Banking App Development

It is crucial to select the appropriate technology stack because each project has its own characteristics, there is no one-size-fits-all stack for web or mobile banking development. Nonetheless, a well-chosen mobile banking technology reduces costs, software development time, and shortens time to market.

Rely on the experience and expertise of a mobile app development company that you have hired. But, make sure you understand why you are selecting certain technologies. What are the long-term advantages and disadvantages of using these technologies?

Tech Stack for Android-based Banking App Development

To build the design part of the content, the front-end tech stack is used. The below table contains the programming language to design the front end of the mobile app.

Tools/Programming Language Explanation Java and Kotlin The most popular programming language is used to develop native Android apps. Android Studio It is an official Android development tool by Google. UI Framework / Jetpack Compose Build user interfaces easily using Jetpack Compose which is known as a modern UI kit. Tech Stack for iOS-based Banking App Development

Tools/Programming Language Explanation Swift Swift is well known for its readability, simplicity, and speed. Xcode It is an IDE powered by Apple to build native iOS mobile applications. UIKit In iOS applications, this is a basic framework for creating and managing graphical components. Databases

We have listed the popular databases used to build Android and iOS apps. Select the database depending upon your mobile banking app project.

Databases Explanation MySQL An open-source SQL database that is multi-threaded and simple to use. PostgreSQL A robust and highly adaptable open-source object-based relational database. MongoDB A schemaless JSON document database with a reputation for scalability and flexibility. SQLite The most typical use of an embedded database is to provide local data storage capabilities on mobile phones. By following the step-by-step procedure, we have developed custom finance applications from scratch.

Check 2 of the best finance apps we have built by applying these tech stacks.

PayNow for Stripe is a simple point-of-sale tool that permits you to use credit card payments from your mobile easily without any hassle. This app has helped our client to get more than 50,000 users and increased ROI by 35x.

PayNowlink: An App for Stripe Checkout

PayNowLink generates the link to complete various transactions. Users don’t need to rely on manual invoices and external machines. Customers can open the link and pay using Stripe checkout.

Security Protocols Implementations

Integrating security protocols is important for the banking app. Whether you are a startup or a banking organization, to revive the client, you need to integrate top-notch security in your mobile app. In short, it is essential to build secure banking apps. Even you need to protect your mobile app from the server end and let your users know about the cybersecurity practices as well.

Implement encryption and security protocols by referring to following table, which explains data privacy guidelines.

Data Privacy Guidelines Explanation PCI-DSS The goal of PCI-DSS is to enhance the data of global payment accounts by building support services and standards, driving awareness, and proper implementation. GDPR The General Data Protection Regulation (GDPR) is the EU’s primary data protection regulation. GLBA and SOX Gramm-Leach-Bliley Act (GLBA) and Sarbanes-Oxley Act (SOX) govern data protection in FinTech in the United States (SOX). CDR Gramm-Leach-Bliley Act (GLBA) and Sarbanes-Oxley Act (SOX) govern data protection in FinTech in the United States (SOX). CP Act In Australia, the Consumer Data Right (CDR) governs financial transactions. Accredited providers are permitted to shift data via consumer data rights services. Integrate Advanced Data Protection

Data security is essential to integrate into banking app development services. It is essential to confirm that your platform follows the security guidelines and distribution region. Additional data security procedures ensure that personal and sensitive user data is kept safe and secure.

Use Authorized APIs Only

Any banking app development choice requires a dependable bank application programming interface (API). Basically, the aim of building an authorized API is to permit the client to access the data securely. For better security, ask your development team to create custom APIs if it is possible within a limited time range. You will have total control over your data and your system.

Example:PayPal / Siri integration: PayPal announced in Sep 2021 that its users can now transfer and request money via Siri. “Hey Siri, send Bill $50 via PayPal,” simply say to get the job done.

Use Tamper Detection Method

When you tamper with an application, you’re tampering with its integrity. When hardening a mobile banking or payment application, one of the most critical jobs to address is preventing the application from being tampered with (‘anti-tamper’). The reason for this is that tampering with, and eventually changing, an application can effectively disable all other security checks done by the application protection system, such as anti-debugging, anti-jailbreak, and so on.

Example:Cycript is one of the most pernicious programs, capable of bypassing various anti-tampering safeguards.

Our dedicated mobile app developers have built an app for one of our clients Mr. Douglas. He was clear with his requirements but wanted to consult us regarding how the development process will occur. Our team explained to him the complete process and helped till the project was completed. Here is the testimonial of Mr. Douglas that you might want to check.

Consistently Test the Mobile App

Prior to releasing the application, it must be tested properly. Tools such as Appium, and Unified Functional Testing (UFT) are well-known tools to test the mobile app. Undoubtedly, releasing is a rewarding moment for any application owner. However, testing the app will help you to polish your mobile app and prepare it for release in Google Play Store and Apple Store. You need to test your application using both the mobile app testing method, manual and automation.

Once you have your app ready, published on the Apple App Store and Google Play Store, what’s next? You need to make sure that your audience and your customers are aware of your application.

Launch the Mobile App to Existing User Base

After successfully publishing your application to Google Play Store and Apps Store, the next step is to market your app. Use your existing user base. When your customers have better UI/UX of the application, better support when required, better offers on the mobile application, you are sure to get more users on your application.

That’s all? No.

After you make your application live, that’s the start of the opportunities. Collect the feedback, talk to your customers, identify what is working and what is not working for them. Create a document. Want to know more about pricing for app publishing? Here is a detailed guide about how much it costs to put an app on the app store.

Want to Know the Cost of Mobile Banking App Development?

Talk to our app development consultant and share your banking app requirement. We will assess and share the exact app development cost with you.

Enhance and Regularly Update App

After asking for feedback, the next step will be to apply the appropriate changes in your mobile app. Test all the changes you perform continuously. Monitor the results and develop your mobile app accordingly. Here are 3 steps to enhance your mobile app.

- Try to use the native component in your mobile app

- Make simple and consistent app design

- Perform remote user testing

We have discussed the step-by-step procedure to build a banking app. Now, to help you get inspired, here are some of the best banking apps we have mentioned for you to check.

Best Smart Mobile Banking Apps

Here is the list of top mobile banking apps, you should take inspiration from.

| Apps | Features | Play Store Ratings | Download |

|---|---|---|---|

Well Fargo |

| 4.7 (14,14,534) | Android | iOS |

Capital One |

| 4.7 (12,42,901) | Android | iOS |

Bank of America |

| 4.5 (9,22,450) | Android | iOS |

Ally Bank |

| 4.0 (21,010) | Android | iOS |

How Much Does It Cost to Build a Mobile Banking App?

Check this guide if you want to learn more about app development cost for different platforms and categories.

This banking app development cost depends on these factors.

| Factors | Explanation |

|---|---|

| The scope of the project | What kind of features do you want to integrate, what goals do you want to achieve, what is included in the app development, and what is not included in the app development. |

| The complexity of app development | Development complexity directly correlates with the price as well. |

| App development technology | Developers who are proficient with the latest technology charge higher. |

| Deadline of the project | If you want to develop and publish your banking application within a fixed timeline, it might require extra developers to successfully make the application live on the App Store and Play Store. So the timeline will directly impact the overall app development cost. |

| API integration | During banking app development, there are APIs like TrueLayer, Galileo, and Barclays APIs that require the paid version. Not much, but definitely, this can increase the overall app development cost. |

You have learned the market states, features, and the flow of baking app development. Now, we will discuss some of the essential FAQs which will help you to give insights on the subject.

FAQs About Mobile Banking App Development

What are the main mobile banking trends?

Here are the major mobile banking trends.

- Biometric security

- Artificial intelligence-powered chatbots support

- Integrating machine learning technology

What should be your priority while building a banking app?

Here are the elements you should prioritize while building a banking app.

- Mobile banking services must include strong security features to build a secure mobile banking app. Therefore, it should be prioritized first. Because thousands of users will access your app and rely on you to keep their money and sensitive data secure.

- Even by prioritizing security features, you can ensure safe mobile payment transactions as well.

- The user experience is also the key factor to consider while building a banking app. It is necessary to keep the fine line by building an engaging and clean banking app.

Ready to Build a Custom Banking App?

This blog covers the market trends, step-by-step procedures to build banking apps, examples of top banking apps, a list of essential features, and the problems that mobile banking apps will solve. In case you have any questions related to mobile banking app development or want to know the cost of custom banking app development, please reach out to us.

While signing up for our mobile app development service, we offer 30 min free consultations in which you can ask any questions you have regarding your mobile app. Our team of Android developers and iOS app developers have experience building more than 4400 apps.